Mapping the Transportation Market

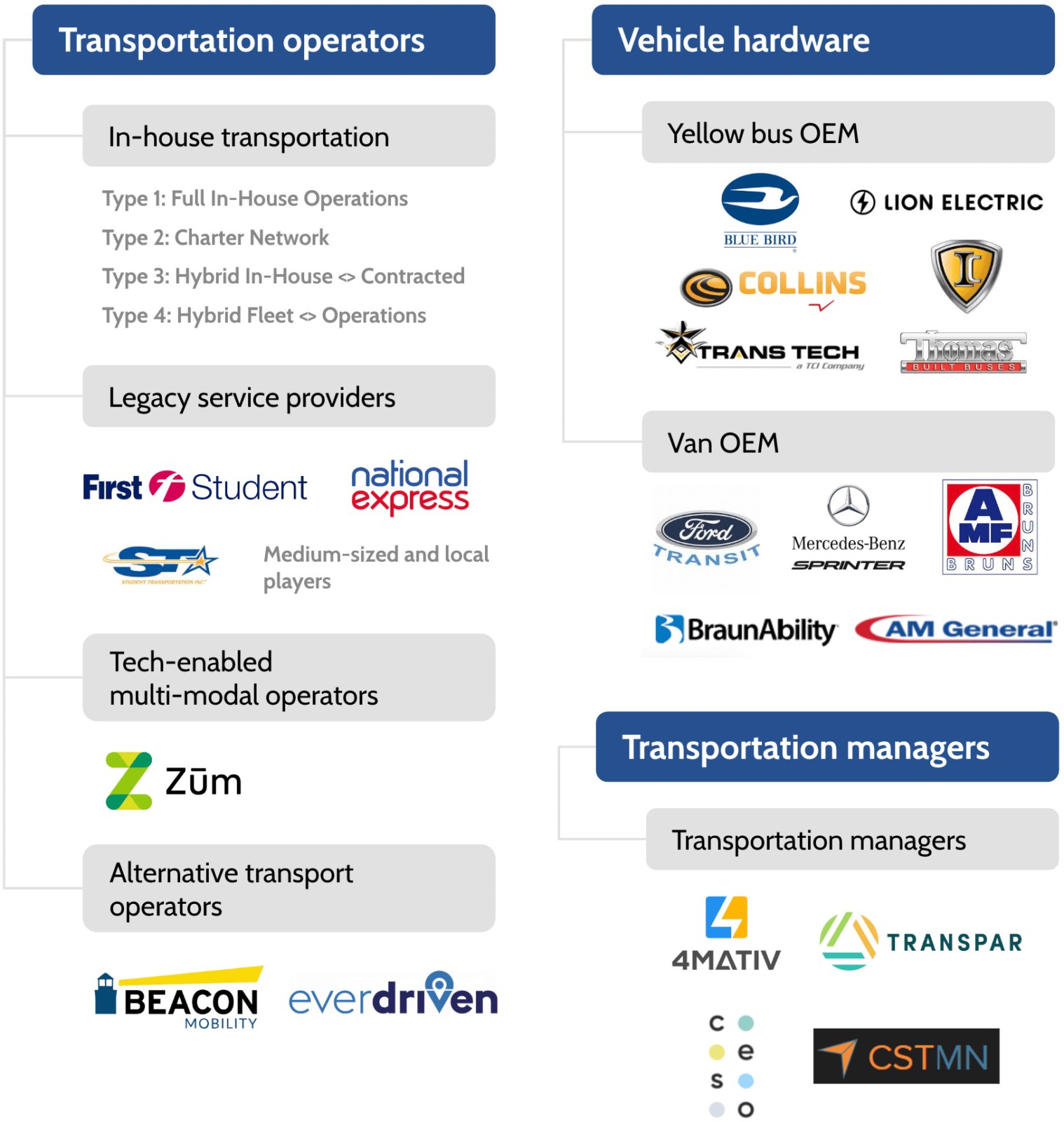

Five core market segments constitute the current student transportation industry:

-

Transportation Operators

-

Vehicle Hardware

-

Transportation Managers

-

TNCs and Carpools

-

Routing and Fleet Management

Together these represent a broad mix of organizations and business models. While most school buses are owned and operated in-house by districts, many districts outsource services to legacy busing providers like First Student and National Express. Both districts and legacy providers face supply chain issues and demand pressures, the growth of non-bus options, the need to harness new logistical, communications and safety technologies, and pressure from drivers to offer enhanced pay and benefits. Sensing an opportunity for disruption and transformation, more investment and technology firms are entering the space, making the market landscape highly dynamic.

Market Map

In House and Legacy Operators Transport Most Students

Around ⅔ of US school-provided transportation services are operated by in-house transportation departments at school districts that are responsible for management and operations of student transportation, including developing schedules and routes, hiring drivers, and managing contractors. In addition to being accountable to improve operations and reduce costs, the advantage of direct control means districts can be more flexible and maintain higher safety and vehicle standards.

The other ⅓ of services are operated by a mix of legacy bus providers, modern tech enabled companies, and alternative transport (van and sedan) operators. With their years of experience, legacy bus operators like First Student and National Express offer large-scale bus operations, safety and maintenance solutions, and are now starting to offer van services. Newer tech-enabled companies like Zum function similarly to legacy providers but add a wider array of multimodal options and a full-stack digital platform that can also replace district’s routing, fleet management, and parent-facing solutions. Companies like Beacon Mobility and ALC Schools (now EverDriven) broker to fleets of SUVs, mini-vans, and wheelchair accessible and special needs vehicles with a focus on service to students who are out-of-district or hard-to-serve.

![]()

Transportation Managers Improve Logistics and Save Money

Transportation managers like 4MATIV and TransPar do not provide their own transportation vehicles but instead act as turnkey transportation departments, subcontracting to a mix of providers, supporting in-house fleets or functions like routing, dispatch & communications, and managing systems’ financial performance. They provide consultative and strategic partnership as well as their own technologies to optimize a school’s operations across all modes, expand options, and help reduce costs.

![]()

Transportation Network Companies and Carpools Emerge to Meet Demand

Transportation Network Companies (TNCs) like HopSkipDrive and Adroit contract directly with drivers using their own vehicles like Uber and Lyft. Such ride-sharing services for children are becoming more popular, especially for parents with special needs students. These services also sell direct to families, allowing on-demand or pre-scheduled pick-up times to shuttle kids between school or activities with drivers that have undergone a higher degree of vetting. In addition, apps like Carpool to School and GoKid and non-profits such as Safe Routes to School and regional Transportation Demand Management organizations have begun providing parents tools that provide safe carpool, walk pool, bike pool, and transit pool coordination services.

![]()

Advancements Improve the Experience for Managers, Drivers, Schools and Families

Routing technology providers give districts the tools to design routes and do some level of optimization. Increasingly, these solutions come integrated with GPS tracking hardware and additional features for school-users, drivers, and families, including parent apps, student tracking/attendance apps, driver mobile/tablet terminals with live navigation, and communications tools. An array of companies build individual pieces of this technology picture, and these can also stand alongside or be fully integrated with other onboard technologies like cameras with video and audio recording, on-board Wifi, driver time and attendance tracking, and smart maintenance management systems.